Solid financial reporting and accounting practices is the foundation for a good business. Without them, you’re betting your business on conjecture and faith. While there are plenty of things in a startup’s life where reliance on assumptions is a risk you must take, your finances are not one of them. And while your investors aren’t going to argue with you about what is a good line of code and what isn’t, they are going to have strong opinions on what right looks like when it comes to your financials.

It’s up to you to be honest with yourself about what you know and what you don’t know, and what is worth learning versus resourcing.

That’s why we recommend that our portfolio companies, and all early stage startups, hire an outsourced CFO who specializes in early stage SAAS companies who can fully handle bookkeeping, accounting, financial benchmarking and reporting.

As an early-stage venture-backed startup, there is never not a good time to get high quality financial reporting in place. Here’s why.

#1. It Makes Your Business Better

Great financials give you the ability to understand your core business metrics and align those metrics to the specifics of your plan. This alignment provides a focused understanding of how specific investments of time and money translate to value and growth. Adherence to GAAP-compliant accounting standards and appreciation for non-GAAP metrics unique to modeling your business, are very distinct, but equally important. Frankly speaking, less than 1% of the companies we’ve evaluated have displayed this maturity. The great story, though, is that in every case where we’ve watched a true expert outsourced CFO shop come onto the team, we’ve seen a complete progression to great in a matter of weeks, at cost less than an average full-time bookkeeper.

#2. It Impacts Your Valuation and Acceleration

One of the objectives that the decision to take investment drives is professionalizing your company. Sometimes that’s the team, sometimes that’s the product, sometimes that’s the go-to-market strategy, but every time it’s the financials. If you plan to grow your business as a venture-backed company with 200% year over year growth, you need to set yourself up for success in future capital raises. Getting your financials in order maximizes your potential and has a direct impact on your valuation, it’s a major value-add to any future fundraise. If you wait until you have to do it, you won’t have the time you need to do it right. What’s more, it’s a clear opportunity to outpace your peers.

#3. It Give You Access to Cross-Market Best Practices

If you do your books and modeling and only your books and modeling, you have a limited scope of experience. You’re missing out on the best practices and insights that come with someone who works with and sees the books of many companies. You lack access to cross-market and market-specific benchmarking. You don’t get to benefit from knowing what pricing models and sales strategies are working for others that you could test and employ in your business. And on top of that, you’re missing out on all the industry knowledge and professional development that someone whose full-time life is to live and breathe this stuff has baked into their workflow.

#4. It Improves Relationships with Your Board

Having an outsourced CFO is having an unbiased opinion on the numbers, a continuously verified, validated, and audited financial truth. It builds trust between you and your board members, you and your investors, and you and your numbers. The outsourced CFO, as a trusted 3rd party, creates and improves trust in the data, and builds trust between you and your board members and investors, because everyone is looking at the same data at the same time. It makes it so that you don’t have to worry about the accuracy of your financial reporting being questioned — no “well how did you get those numbers?” — because you have an expert on your team who is accountable, and will help you own the numbers, see issues before they are problems, and make better decisions.

#5. It is Not the Best Use of Your Time

There are two big patterns we’ve seen in companies trying suboptimally to manage their financials. The first is a poorly fit early hire who understands finance technically but lacks the experience to pair those metrics to the market, or is over-experienced for key functions of the role, thereby failing to add maximal value. The second is a CEO or other member of the leadership team trying to play CFO, which is both unsuccessful and a waste of their time. We would rather see those precious hours dedicated toward closing customers, recruiting new rockstars, and forming strategic partnerships, as well as just managing a great team. As the CEO, you have a responsibility to your team, and have made a promise to your investors, that you will spend money and time in the best way possible to further your company’s growth. Great CEOs cannot be great CFOs at the same time.

What Now?

Again, it’s not that we don’t think you could do this as an entrepreneur. It’s just that we think it’s not the best use of your time and money, nor do we think you’re the best possible resource to do the job.

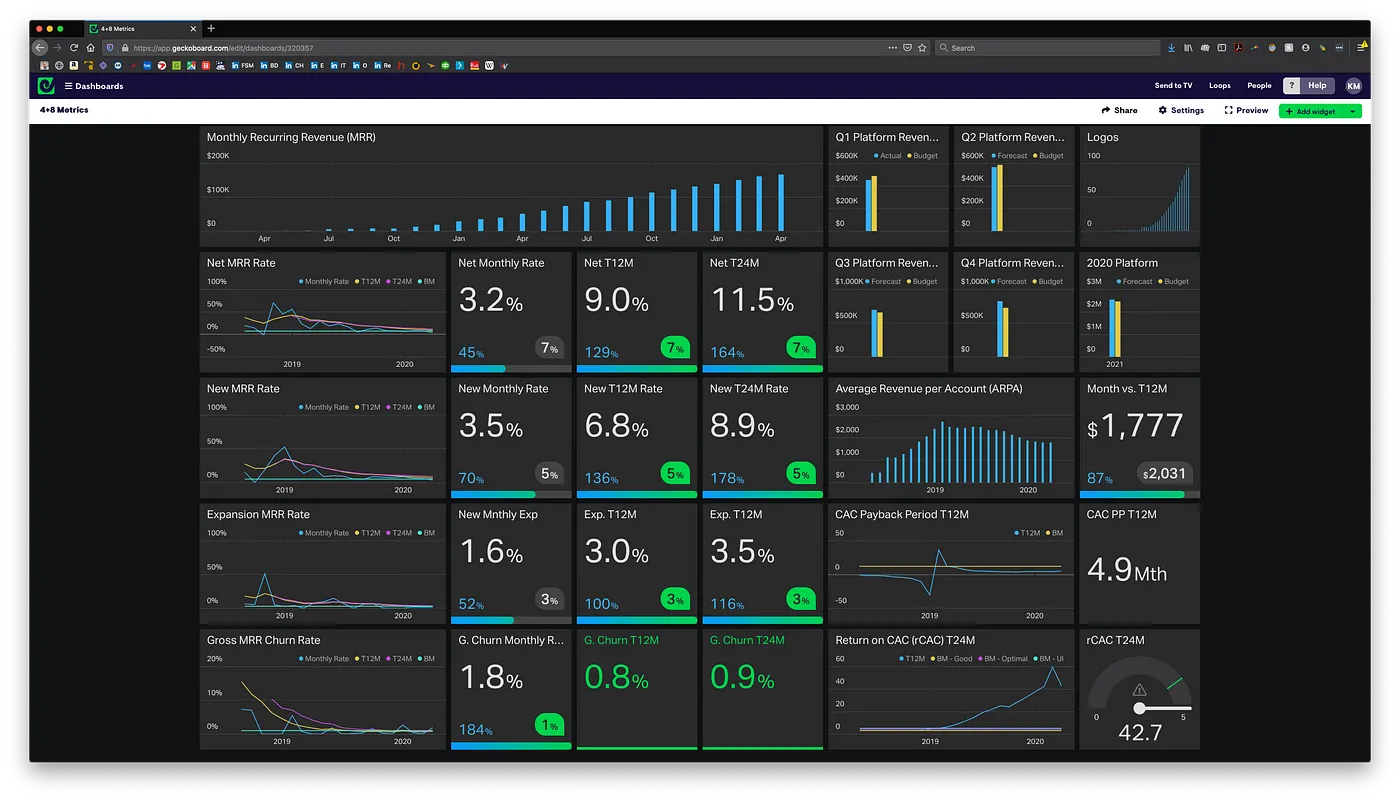

Ask your investors, advisors, friends, and other entrepreneurs for connections to outsourced CFO resources who specialize in companies at your stage and completely get your business model. Arm yourself with great examples of pro-forma projections, KPI dashboards, and great financial board-level reporting and find somebody who will excel at that. It’s important to work with a group that understands the startup lifecycle and is priced accordingly at the early stages.

For what it’s worth, we think that 4% of annual subscription revenue should provide a budget for the right opportunistic firm to jump at. Finding the right fit means that they will be well aligned to grow with you over time.

If you don’t know who to ask, ask us. We will be happy to put you in touch with one of our founders to share their experience working with a professional outsourced finance team.

Comments