Many entrepreneurs — including yours truly, in a former life — gravitate towards an obsessive focus on revenue as the most important statistic in explaining their company’s growth path. However, with software companies in particular, the underlying unit economics are simply much more important in both the short and long term. They certainly affect the long-term profitability of the company, and frankly have a massive impact on the attractiveness of the company to a future acquirer.

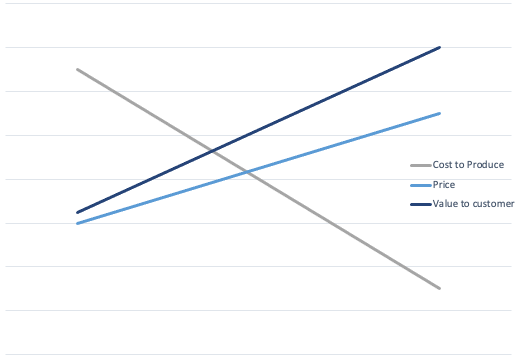

When we talk about unit economics, we’re referring to two separate buckets — first, the cost to make and deliver a product or service and the amount the customer is willing to pay, and second, the cost to acquire and retain customers. We are investing in an entrepreneur’s ability to repeatedly complete those activities over and over again in a profitable way — at a total cost that is significantly lower than the customer’s willingness to pay, which is in turn much lower than the value to that customer. That’s what we’re investing in. We value that more than we value revenue itself.

The Cost of the Product

The first critical piece in achieving great unit economics is understanding and eventually decreasing your costs. When we talk about software, the assumption is that the marginal cost of producing an additional unit of sale is zero. That’s true for the software itself, but we also know that the marginal cost to build, install, service, and continually improve that software, is not zero — all those activities will continue to have costs. So we need to know that the costs of all those activities will collectively add up to less than the customer’s willingness to pay, and that if they don’t currently do so, that they’re trending downward. As investors, we need to understand what those costs are and how much they could eventually decrease, and how that compares to the value to the customer.

We’re trying to understand where the inflection points are on the path to profitability, and how investments can be made to accelerate progress to those points. We want to hear how architectural decisions contribute to that progress when we talk product roadmap. We insist that our founders start proving out unit economics early so there is a very viable path to profitability. We don’t demand profitability, we demand unit economic proof points and a clear path to profitability. Two very different things.

The Value Proposition to the Customer and Their Willingness to Pay

When we diligence a company, we’re trying to understand what is the customer’s willingness to pay, and how much money is this product or service is either making them or saving them. If we’re going to sell something for $2, it better create (or save) at least $5, hopefully $10, of value for the customer and it should cost us no more than 50 cents to make and sell. We want to determine that a customer is spending $100,000 on a given product or service and that same customer obviously saved $500,000 because of that purchase.

The key word there is obvious — if the savings is not obvious to the customer, or it’s not obvious to us, then we argue that that $100,000 cost is not sustainable in a budget-conscious enterprise. When that savings (or gain) is obvious, we can have confidence that the customer will continue to buy a product and fight for it in their budget.

Said another way, people don’t spend money to break even. There is a loaded cost and an opportunity cost to every dollar that gets spent in the enterprise. We have to be the best possible use of that dollar, and the value needs to be quantifiable and dependable. Your product or service has to be both better and cheaper than all the competition, and you have to be able to prove to a customer they’ll see X% cost savings and Y% quality improvement. We’re going to talk to those customers, and we are looking for them to confirm that assertion. Most importantly, we’re going to look for consistency across multiple customers with respect to that value creation.

Examining Cost of Sales & Marketing, and Defining Good Revenue vs. Bad Revenue

The third piece of this is the one that many founders lose sight of — that the primary objective is not revenue. The primary objective is being or becoming a large, profitable business in an efficient, measurable, predictable and repeatable way.

Let’s talk about the converse for a moment. We often see companies that achieve strong revenue numbers through heroics, not fundamentals — in a few common ways:

- They throw the kitchen sink at sales in a given month, exhaust the entire team, pull in every favor they have. They might have a huge month or quarter but weak pipeline. Perhaps the CEO was simply so compelling and convincing that they landed deals a sales team could never sell. That’s not sustainable, and those numbers don’t scale once investments are made and the team is expanded.

- We see companies that achieve revenue through a single customer that’s unrepresentative of the greater market. You convince someone to pay an amount that is unlikely to be repeatable. We see this a lot with government contracts — you close a multimillion-dollar deal with a branch of the military, but can’t get more than $100,000 per license in a commercial market. So that $4M revenue in one month doesn’t really mean anything for profitability.

- Then there’s achieving revenue through inefficient unit economics, where every new increment of revenue requires investment in a new engineering initiative. That means every dollar you’re earning is going to be accompanied by an increase in costs. So we don’t see any economies of scale or decreases in costs over time.

That’s not to say we aren’t willing to invest in activities that aren’t directly profitable — we are. We’re willing to fund innovating and building a product, and we’re willing to fund entering an existing market or creating a new market. Those are “unprofitable” investments that are worth funding, but it all must eventually surrender to profitability. And it’s the responsibility of the entrepreneur, through a compelling case on the unit economics, to prove to us that over time that will happen and profitability will be achieved.

Investors — and customers — don’t invest in nice-to-haves. They invest in companies that offer the best possible way to spend money in a space, to solve the problem. There are plenty of articles that wonderfully explain the different statistics and ratios that matter for any particular industry. Knowing how your business stacks up is absolutely essential to making a powerful investor pitch and getting funded.

Comments